LTC Price Prediction: Technical Strength and Positive Catalysts Signal Investment Potential

#LTC

- LTC trades above its 20-day moving average, indicating near-term bullish momentum

- Grayscale's ETF applications for LTC provide fundamental support and institutional validation

- MACD shows some divergence, suggesting need for caution despite positive technical positioning

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

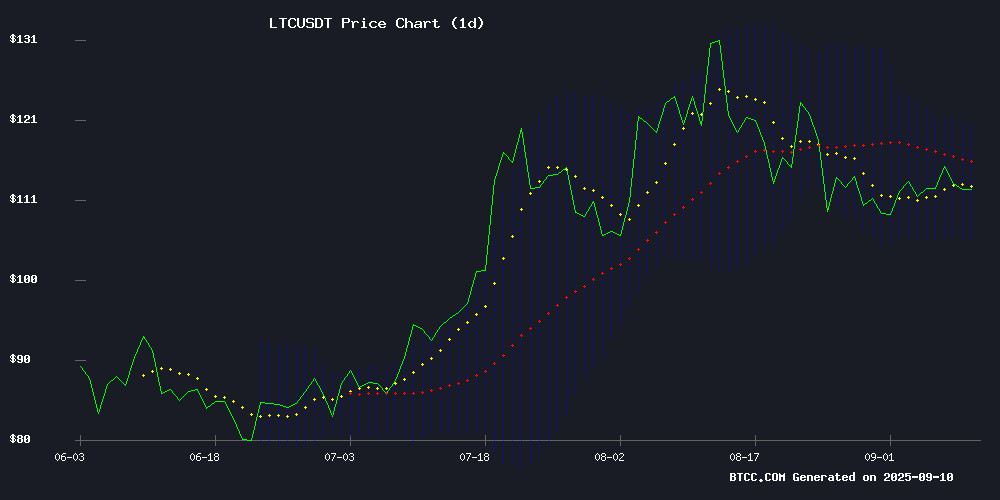

LTC is currently trading at $115.03, positioned above its 20-day moving average of $113.20, indicating underlying strength in the current trend. The MACD reading of 2.71 versus 4.26 suggests some near-term momentum divergence, though the price remains within the Bollinger Band range of $105.74 to $120.66. According to BTCC financial analyst Olivia, 'LTC's ability to hold above the 20-day MA while maintaining position in the upper half of the Bollinger Band configuration points to continued bullish potential, with resistance likely around the $120.66 upper band level.'

Market Sentiment Boosted by Institutional Interest and ETF Developments

Recent news highlights growing institutional engagement with LTC, particularly through Grayscale's new ETF applications for BCH, HBAR, and LTC. This development, combined with broader industry trends toward cryptocurrency infrastructure optimization and cloud mining profitability, creates a favorable backdrop for LTC. BTCC financial analyst Olivia notes, 'The ETF application momentum and expanding cloud mining opportunities are generating positive sentiment that complements the technical picture, though investors should monitor the SEC's delayed decisions on similar crypto ETFs for broader market implications.'

Factors Influencing LTC's Price

Tech Firms Explore Dogecoin and Bitcoin Mining Partnerships to Optimize Infrastructure

Mining remains a cornerstone of the cryptocurrency industry, with Dogecoin (DOGE) and Bitcoin (BTC) mining leading the latest wave of infrastructure innovation. As debates over price volatility dominate headlines, behind-the-scenes advancements are reshaping blockchain scalability and efficiency. Technology providers are now actively pursuing collaborations to integrate Dogecoin mining with existing Bitcoin mining operations—a move aimed at maximizing energy utilization, streamlining hardware deployment, and fostering cross-community accessibility.

The synergy between Dogecoin and Bitcoin mining underscores a strategic shift toward sustainable solutions. Bitcoin's proof-of-work consensus continues to set the gold standard for network security, despite ongoing energy concerns. Meanwhile, Dogecoin's resurgence highlights its enduring relevance among major cryptocurrencies like Ethereum (ETH), Solana (SOL), and Ripple (XRP). This convergence comes as global cryptocurrency adoption accelerates, pushing enterprises to seek scalable mining frameworks.

Solana and Remittix Emerge as Top Crypto Contenders for 2025 Growth

Solana (SOL) and Remittix (RTX) are drawing significant attention as potential high-growth cryptocurrencies, with analysts projecting a 25x surge for RTX by 2025. Solana's institutional appeal and ETF speculation contrast with Remittix's focus on solving real-world payment inefficiencies.

Solana's price hovers around $214–$215, buoyed by technical indicators like whale accumulation and a golden cross on the SOL/BTC pair. Regulatory optimism around a potential spot ETF adds to its momentum, though upside appears measured compared to Remittix's ambitious PayFi model.

Remittix quietly outperforms established players like Ethereum and Litecoin in 2025 projections, leveraging tangible utility over hype. Its structured roadmap and quantifiable metrics position it as a dark horse in the race for payment infrastructure dominance.

SEC Delays Decisions on Bitwise Dogecoin ETF and Grayscale Hedera ETF to November

The U.S. Securities and Exchange Commission has deferred rulings on two high-profile cryptocurrency ETFs, pushing deadlines to November 12. Bitwise's Dogecoin ETF and Grayscale's Hedera Trust now face extended scrutiny as regulators take full review periods rather than issuing early determinations.

Grayscale simultaneously updated filings for Bitcoin Cash and Litecoin trust conversions, signaling continued institutional interest in crypto investment vehicles. Over 90 ETF applications remain pending before the SEC, including products tied to Solana and XRP—a backlog reflecting both regulatory caution and growing market demand.

The delay comes amid unprecedented altcoin ETF activity, with at least 31 applications filed in 2025's first half. Market observers note the SEC's pattern of utilizing entire review periods suggests deliberate evaluation rather than outright rejection of crypto products.

Cloud Mining in 2025: AIXA Miner Leads with Profitability and Trust

The cryptocurrency market continues its upward trajectory in 2025, with Ethereum surpassing $4,000 and Bitcoin nearing the $100,000 threshold. While major cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, and Dogecoin dominate, the broader market faces pressure. Investors are increasingly turning to efficient mining solutions to capitalize on these gains.

Traditional mining methods are plagued by rising hardware costs, maintenance challenges, and escalating electricity expenses. Cloud mining has emerged as a compelling alternative, offering access to large-scale mining farms without the technical or financial burdens of physical rigs. Users can generate passive income quickly by renting computational power from providers.

However, the expanding cloud mining sector is rife with challenges. Some providers impose high fees, enforce restrictive contracts, or lack transparency. Among the crowded field, AIXA Miner stands out as a top performer in both profitability and reliability, making it a preferred choice for savvy investors.

Grayscale Submits New ETF Applications for BCH, HBAR, and LTC

Grayscale has filed fresh applications with the SEC to convert its Bitcoin Cash (BCH), Hedera (HBAR), and Litecoin (LTC) closed-end funds into spot ETFs. The move mirrors its successful 2024 conversions for Bitcoin and Ethereum products. Proposed listings target NYSE Arca, pending regulatory approval.

The BCH fund alone holds over $202 million in net assets as of June 30, trading at $4.31 per unit. ETF conversion would eliminate the premium/discount volatility inherent to closed-end structures through dynamic share creation.

SEC scrutiny continues as the regulator simultaneously deferred decisions on Grayscale's HBAR ETF and Bitwise's Dogecoin ETF filings. Market participants view these developments as critical tests for broader altcoin ETF adoption.

Top 5 Cryptocurrency Cloud Mining Platforms for 2025: ZA Miner Leads with $2,400 Daily Profit Potential

Cloud mining has evolved into a streamlined investment avenue in 2025, eliminating the technical barriers of early cryptocurrency mining. Platforms now enable users to generate Bitcoin, Dogecoin, or Litecoin with minimal effort. Yet, the prevalence of scams demands cautious evaluation.

ZA Miner dominates the 2025 rankings by prioritizing transparency and consistent profitability. Unlike competitors prone to overpromising, the platform delivers verifiable daily returns through its large-scale mining operations. Its sustainable model contrasts sharply with defunct ventures like CNC Radiator.

The cloud mining sector's growth reflects broader institutional adoption of cryptocurrency infrastructure. However, investors must still conduct due diligence—legitimate platforms coexist with fraudulent schemes capitalizing on the mining boom.

Where Can You Earn Bitcoin Daily? 7 Best Cloud Mining Platforms in 2025

Cryptocurrency mining has undergone a radical transformation over the past decade. Gone are the days when lucrative Bitcoin mining required expensive rigs, boundless electricity, and technical expertise. In 2025, cloud mining dominates, enabling everyday users to earn Bitcoin, Dogecoin, and Litecoin with nothing more than an internet connection.

The democratization of mining has attracted a flood of new participants—and with them, a proliferation of unvetted services. Distinguishing legitimate platforms from scams now demands rigorous scrutiny. This ranking evaluates seven cloud mining providers poised to lead the industry in 2025, with ZA Miner emerging as the standout for transparency, speed, and profitability.

ZA Miner redefines reliability in digital asset earnings. Its transparent contracts, instant transaction processing, and globally accessible security framework set a new standard for user trust—a rare combination in an industry still rife with opacity.

FY Energy's Cloud Mining Platform Promises $100K in 30 Days as Crypto Dominates 2025 Finance

Bitcoin continues to set the standard for digital assets in 2025, with Ethereum expanding its dominance in DeFi and NFTs. Altcoins like Litecoin and Dogecoin have cemented their roles in payments, yet investors grapple with extracting consistent profits from volatile markets.

Cloud mining emerges as the solution—eliminating hardware hassles and energy costs while generating passive income. FY Energy, a FinCEN-certified platform, claims users can multiply capital to $100,000 within 30 days through its green mining operations.

Traditional trading remains fraught with timing risks, but mining offers stability. The shift to cloud-based models reflects growing institutional preference for predictable returns over speculative trading.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment case. The price trading above the 20-day moving average suggests underlying strength, while institutional interest through ETF applications provides fundamental support. However, investors should consider both opportunities and risks:

| Factor | Assessment | Impact |

|---|---|---|

| Price vs. 20-day MA | Above average ($115.03 vs. $113.20) | Bullish |

| Bollinger Band Position | Upper half of range | Moderately Bullish |

| MACD Momentum | Some divergence present | Neutral to Caution |

| ETF Applications | Grayscale submissions active | Positive Catalyst |

| Regulatory Environment | SEC delays on similar ETFs | Risk Factor |

As Olivia from BTCC summarizes, 'LTC shows technical resilience supported by growing institutional interest, making it a candidate for strategic allocation, though regulatory developments require careful monitoring.'